Alpha Squared Capital

2020 Annual Letter

12/31/19 – 12/31/20 Performance [Net of Fees]

| ASC - Active | ASC - Passive | S&P 500 | |

|---|---|---|---|

| Returns | 43.58% | 30.46% | 16.26% |

| ALPHA | 34.35% | 16.11% | n.a |

Swipe Right to Left to See the Whole Table

January 1st, 2021

Alpha Squared Capital (ASC) Clients,

Together we have endured a year the history books will never forget. From all of us at ASC, thank you for entrusting our team with your finances. Within our letter we discuss our portfolios, outlook and achievements.

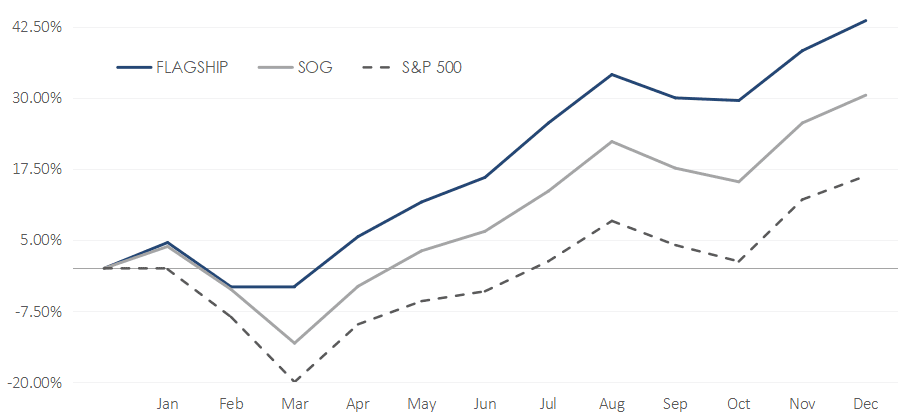

2020 Performance Chart – Monthly Returns [Net of Fees]

The turn of the decade certainly brought a fair share of memorable events and challenges – a global pandemic, fan-less professional sports, wildfires, hurricanes, stay-at-home orders, work from home, virtual classrooms, and a presidential election. Only one word can encompass all that happened in 2020: Volatility. Near the end of Q1, the U.S. equity markets experienced one of the most aggressive corrections ever witnessed on Wall Street. While markets have since recovered, many individuals, businesses, and families may have not; our prayers go out to those affected by COVID-19.

While every year might not be as action packed as the turn of this decade, a cornerstone of our active investment strategy is to attempt to limit downside risk through tactical management and market hedges. The hypothetical example below illustrates how mitigating losses can dramatically reduce the growth required to break-even:

ex.: i.e.: Portfolio loses 50% – Requires 100% return to break-even

i.e.: Portfolio loses 25% – Requires 33% return to break-even

Portfolio performance is a focus at ASC; the term alpha, which means superior risk-adjusted return, is in our name. However, it is only one piece of the wealth management puzzle. Financial Planning is equally, if not more important. Not only do we strive to deliver alpha on client assets but also to provide industry-leading financial advice.

The actively managed ASC Flagship Growth Portfolio had an outstanding year. Our premier portfolio comprises of approximately 25 individual companies in which majority possess market capitalizations greater than $10B. Substantial diversification is provided through exposure in sector and index-based ETFs. The strategy attempts to exploit individual equity growth of large-cap equities with the heaviest weights in index-linked ETFs and mutual funds due to the excess demand of fund flows and strong unit economics of companies this size. With a diversified mix of companies in which we believe to be high quality, this portfolio intends to deliver superior risk-adjusted returns for the growth investor.

ASC Flagship entered 2020 fully invested. At the end of February 2020, we began selling long positions and raising cash to reduce equity exposure as global COVID cases began to escalate. One of our market hedges (long volatility: VIX futures) was used to reduce exposure to the possibility of major downside swings. While this hedge was effective, it was trimmed out of the portfolio too early – causing a reassessment of strategy. Short selling, and additional long selling, prevailed as additional technical indicators were violated. Reentry into a net long weight was gradual but persistent as timing a market bottom is nearly impossible. Basing buy-side entries off technical and algorithmic indicators, we were able to capture a competitive average cost-basis into our selected equities and ETFs compared to the S&P 500 bottom of roughly $2,200. In March 2020, Flagship posted a positive return while the S&P 500 posted a 12.5% loss. Turnover was high throughout the severe COVID downturn but irrelevant as the majority of Flagship funds are qualified. Beginning in early August, we began trimming positions with sizable runs (75-400%+) back to their natural weight within Flagship and continued to do so throughout the month. With heavier than normal cash, we also entered our market hedges by going into a long volatility position and index shorts on the Nasdaq 100 and S&P 500 with 3 times leveraged inverse ETFs during September, realizing gains. With the election looming in early November, the active portfolio was targeting a 75% net long position after accounting for cash and hedge positions. Shortly after the election we began allocating back into long positions due to positive market tailwinds ensuing from Pfizer’s phase III vaccine release which was soon followed by positive vaccine news from Moderna and Astrazeneca.

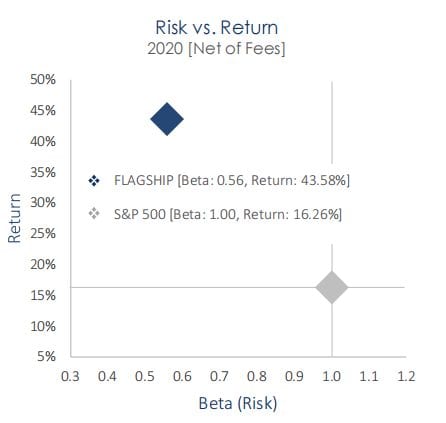

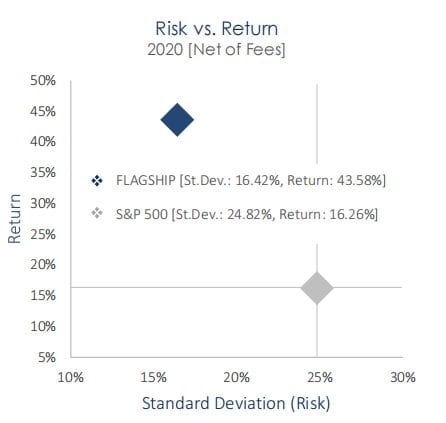

This year, Flagship posted positive returns for 9 out of the 12 calendar months relative to the S&P 500 posting 7 positive periods. These returns were achieved given remarkable levels of risk-management. The Flagship return is compared to the S&P 500 below given the two measures of risk, beta and standard deviation:

It is important to note that Flagship returns this year were better than expected given volatility levels in 2020.

The passively managed ASC Sector Overweight Growth (SOG) Portfolio also had an outstanding year. Our passively managed portfolio seeks to outperform the benchmark index, the S&P 500. The portfolio employs a sector overweight investment approach designed to similarly track the performance of the index. The buy and hold strategy invests in passive index and sector-based ETFs by sampling the index, meaning it holds a broadly diversified collection of securities that, in the aggregate, approximates the index in terms of key characteristics.

The SOG buy and hold strategy performed strongly due to the specific equity sector diversification. The defensive sector we overweight in this portfolio did not hold up during the COVID decline like previous market pullbacks. We believe this was due to the unprecedented economic conditions affecting the sector’s core function. However, the growth sector we overweight in this portfolio provided stability, resulting in a limited decline compared to the S&P 500. Clients who participated in dollar-cost averaging into SOG benefited from the violent end to Q1 as the buying strategy specifically aims to reduce volatility.

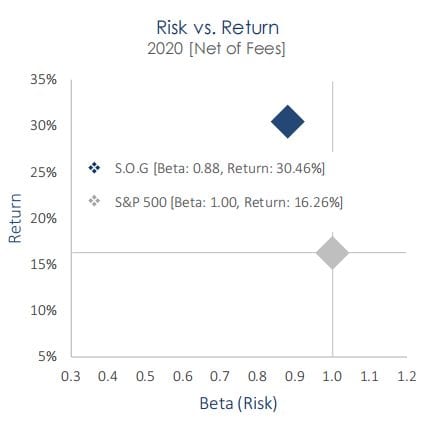

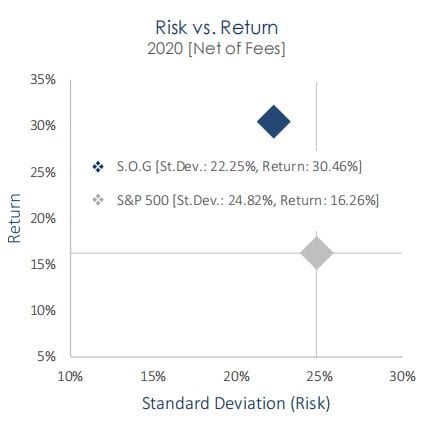

This year, SOG posted positive returns for 8 out of the 12 calendar months relative to the S&P 500 posting 7 positive periods. These returns were achieved given remarkable risk-levels measured for the year. The ASC SOG return is compared to the S&P 500 below given the two measures of risk, beta and standard deviation:

As we stick to our strategy, we can navigate markets by methodically trading in an attempt to protect and grow client capital, here’s our current outlook:

- Throughout the majority of the year, there has been one global constant – the search for yield. The declining interest rate environment is driven by aggressive quantitative easing methods used by central banks globally. Internationally, some nations have pushed interest rates negative. Domestically, the U.S. is still a reliable global safe haven with rates targeted between 0-0.25%. Fed Chair Jerome Powell is likely to keep rates here through the end of 2021. Because the largest individual wealth holders and institutional investors, like insurance companies, endowments, and pensions, hold the majority of wealth, we foresee the global and domestic search for yield continuing as both groups rely heavily on investment income.

- We will likely stay on our fundamental valuation holiday. Complimenting the point above, the low interest rate environment is a blessing for equity markets. Debt heavy companies who have borrowed at lower rates are experiencing naturally growing profit margins while COVID beneficiaries across the TMT sectors have experienced the benefits from government stimulus and earnings growth due to the shift online. What I mean by this is the combination of earnings tailwinds coupled with massive stimulus has allowed for valuations to become stretched to historic levels.

- Active risk managementis especially important as equity valuations become comparable to the dot com bubble earlier this century.

- Declining U.S. Dollar. Increased Inflation. With the introduction of ‘infinite quantitative easing’ from the Federal Reserve, the dollar’s value has diminishedand inflation is expected to reach higher than normal levels as the economy continues its recovery. With interest rates at historically low levels and an expected strong inflationary cycle fueled by rampant money printing, we believe equity growth is imminent as investors continue the search for yield and protection from inflation.

- Runoffs scheduled in early January for the Georgia senate race will impact the political landscapemoving forward. With President-elect Biden taking office on January 20th, the gridlock his administration may experience in office will be dependent on how these final senate seats playout. If one of the seats stays red, the government will be split which can be seen as a positive catalyst for equities as corporate taxes will most likely keep their current rate.

- 9 months after being declared a pandemic, Pfizer, Moderna and Astrazeneca all released positive COVID-19 vaccine results. Delivering the results with great efficacy, the rotation from growth to value began taking place. With the U.S. stock market being a highly efficient discounting mechanism, flows from tech-driven COVID beneficiaries to more cyclical areas of the market took place rapidly as the economic reopening trade became popularized. While we believe specific cyclical sectors will continue to recover, tech-oriented companies will continue to drive long-term market growth.

Internally, one of our values at ASC is producing shared success. Due to your success as clients, we at ASC also had a successful year. I am pleased to announce follow achievements internally:

- Benjamin Howard was promoted to Managing Director. Ben is a Summa Cum Laude graduate from W.P. Carey School of Business with a B.S. in Finance and minor in economics. You can read more about Ben’s impressive resume on the bio section of our website.

- Michael DeFaria has been promoted to Financial Advisor. Mike is a B.S. in Finance and minor in Data Analytics. You can read more about Mike’s impressive resume on the bio section of our website.

- A big congratulations to our 2020 intern classes who have advanced to new internships or full-time roles at J.P. Morgan, Vanguard, Fisher Investments, PayPal, Oracle and other well-respected companies.

- ASC grew by over 170% since our last annual filing in March 2020. This is in part to new assets and clients combined with above-average portfolio returns.

Disclosure:

The performance presented above is solely for informational purposes and represents the time period between 12/31/2019 – 12/31/2020. Actual performance levels for clients vary based on when they entered the model(s). Each model requires a certain level of assets to be accurately allocated among the selected securities. Performance data reflects ASC actively managed “Flagship Growth” model charged 2% between 12/31/2019 – 12/31/2020 and ASC passively managed “Sector Overweight Growth” model charged 0.30% between 12/31/2019 – 05/28/2020 then charged 1.00% between 05/29/2020 – 12/31/2020. Specific advisory fees assessed may have varied among clients. Performance data reflects highest advisory fee assessed for the given model over the specific time periods mentioned above. Standard deviation and beta are annualized based off monthly returns. Alpha calculated using Capital Asset Pricing Model (CAPM). Data pulled from U.S. Department of Treasury website. 3-month treasury bill is averaged over the time period 01/02/2020 – 12/31/2020. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Alpha Squared Capital, LLC unless a client service agreement is in place. Please contact us at your earliest convenience with any questions regarding the content of this letter and how it may be the right strategy for you. For actual results that are compared to an index, all material facts relevant to the comparison are disclosed herein and reflect the deduction of advisory fees, brokerage and other commissions and any other expenses paid by Alpha Squared Capital, LLC’s clients. An index is a hypothetical portfolio of securities representing a particular market or a segment of it used as indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses and cannot be invested in directly.

This commentary reflects opinions, viewpoints and analyses of Alpha Squared Capital, LLC, which are subject to change at any time without notice and are not intended to provide specific advice or recommendations for any individual or on any specific security or strategy. Please contact a financial advisory professional before making any investment decisions.

Alpha Squared Capital, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Alpha Squared Capital, LLC and its representatives are properly licensed or exempt from licensure. More information about Alpha Squared Capital, LLC including our investment advisory fees are described in Form ADV Part 2 available on the Investment Adviser Public Disclosure website.

“Likes” are not intended to be endorsements of our firm, our advisors or our services. Please be aware that while we monitor comments and “likes” left on this page, we do not endorse or necessarily share the same opinions expressed by site users. While we appreciate your comments and feedback please be aware that any form of testimony from current or past clients about their experience with our firm is strictly forbidden under current securities laws. Please honor our request to limit your posts to industry-related educational information and comments.

Committed to excellence.

Contact

Start a Conversation

Address

Find Us

8777 East Via De Ventura #350

Scottsdale, Arizona 85258

Alpha Squared Capital is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Alpha Squared Capital and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Alpha Squared Capital unless a client service agreement is in place.